Now that we have a general idea about the SM operation we can step into the world of VSA.

VSA involves analyzing each bar with respect volume, spread and close. We will ignore the open. Also while analyzing the bar action we will also keep in mind the general background of the market.

As a first step let us make some definitions. These are elementary and most of you understand this. But for the sake of synchronizing our thought I will repeat these here.

Some Basic Bar definitions.

Upbar - A bar would be called a up bar if the close of the bar is above the close of the previous bar.

Downbar – A bar would be called a Downbar if the close of the bar is below the close of previous bar.

Spread – Spread is the difference between High and Low.

A wide spread Bar – If the spread of the bar is above 1.8 times the average spread then we will term it as a wide spread bar. The factor of 1.8 is a tentative one.

A narrow spread bar – if the spread of the bar is 0.8 times the average spread then we will term in a narrow bar. The factor 0.8 is again tentative.

Note:

The problem of calculating the average spread is that during volatile period the average spread is high and in non volatile period the average spread is lower. So a bar which could be termed as a wide spread bar (WRB) in non volatile times could become a average or even a Narrow spread bar (NRB) in volatile times. For simplicity sake and to take the discussion forward we will keep the above factors common. At a later stage we can discuss about methods to arrive at better methods of defining the average which works at all times.

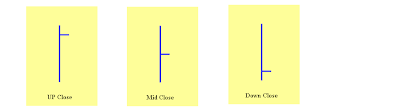

Now let us define some Close positions.

Up close : A close near the High would be termed as a Up close. (Upper 30% of the Bar)

Down close: A close near the Low would be termed as Down close (Lower 30% of the Bar )

Middle close: A close in the middle would be termed Mid close (between 30% to 70%)

Please note that the values mentioned above could be controversial. But for this discussion we will take these values and move forward.

Now we have some basic tools to analyze the bars. Next we will look at volume.